Foresight was 2020

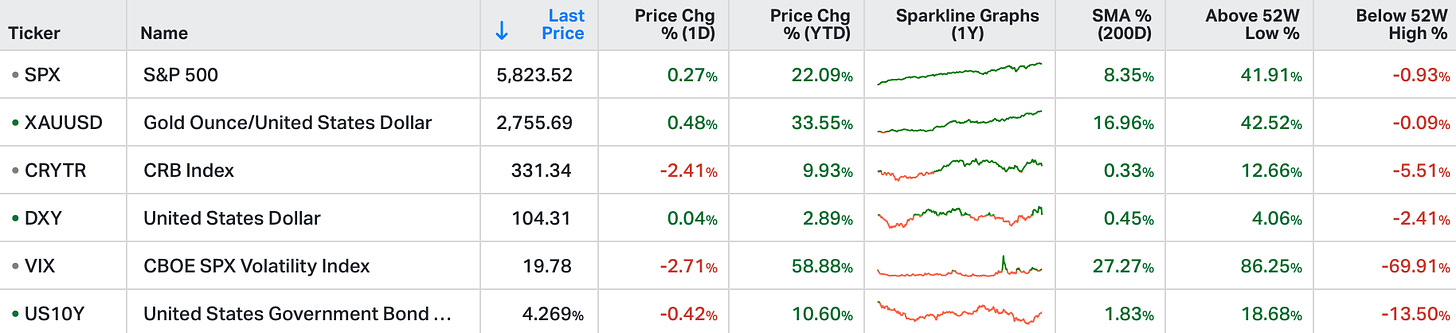

US stocks ended Monday in the green, with the S&P 500 and Nasdaq up 0.3%, and the Dow Jones adding 274 points, as relief spread among traders after Israeli airstrikes on Iran avoided oil and nuclear facilities, easing initial fears.

Investors are now gearing up for a packed week of earnings, with five of the "Magnificent Seven" megacaps Apple (0.9%), Meta (0.9%), Amazon (0.3%), Alphabet (0.9%), and Microsoft (-0.4%) set to report their quarterly results.

Additionally, key economic releases, including GDP growth estimates, PCE inflation, and payroll data, will offer further insights into the U.S.

economy’s resilience, as the presidential election and the Federal Reserve’s monetary policy decision approach next week.

The tech sector led gains, followed by advances in consumer discretionary, financials, and real estate, while energy shares declined.

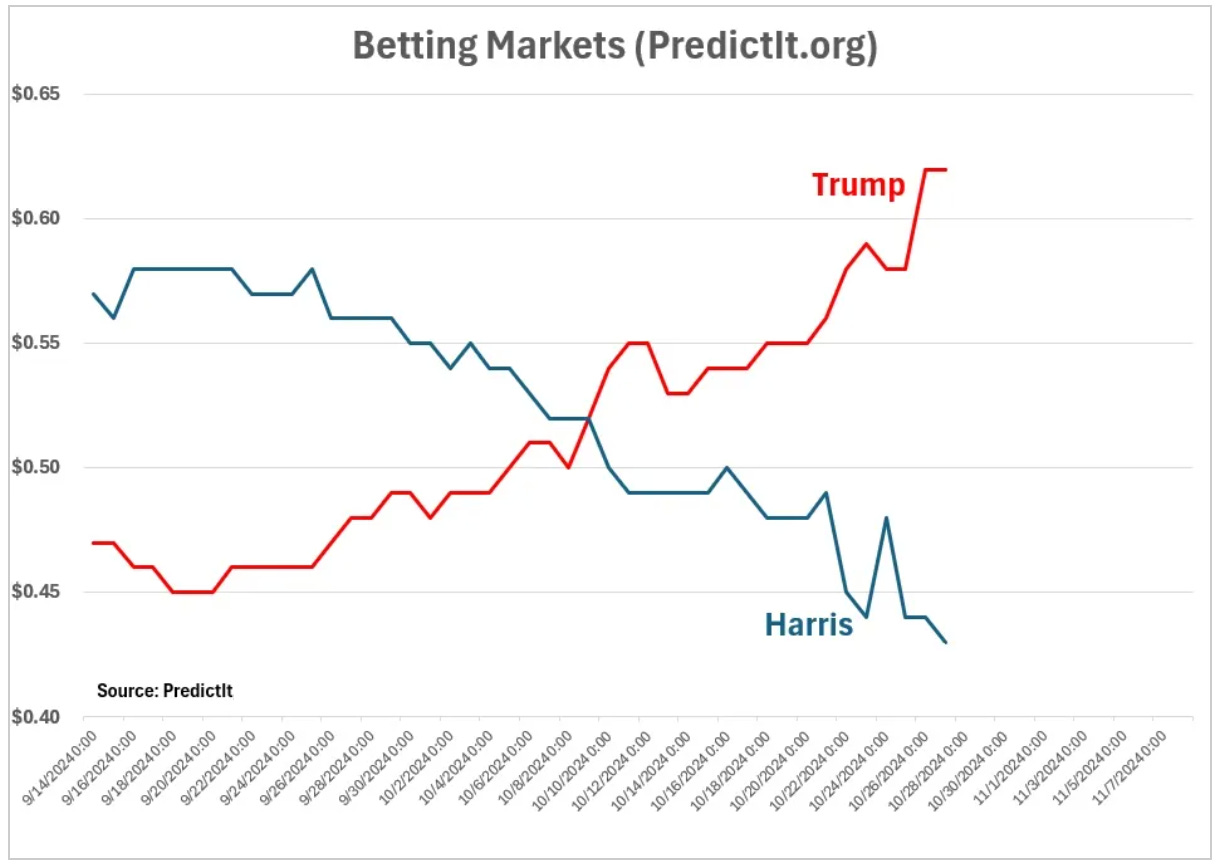

The betting markets have continued to widen in favour of a Trump win. This pattern is similar across all of the top prediction platforms.

The Republicans are widely expected to win the Senate, and the betting markets are pricing in about a coin flips chance of a fully aligned government (a House win as well).

With that, small cap value stocks outperformed broader stocks on this outlook of more business friendly, pro-growth policies. If we look back at 2016, for those reasons, the Russell 2000 doubled the performance of the S&P in the two months following the Trump win (+17% vs. +8%).

This growing probability of a Trump win is bubbling up in a few other areas. In media, the LA Times didn't endorse a candidate. Nor did the Washington Post. And Jeff Bezos just penned this opt-ed in his Washington Post ( click here ) …

This sounds like a mea culpa on a failed influence campaign.

We will see.

It's a very high stakes election, with a binary outcome on policy path and governance. On that note, I want to revisit my piece from election day in 2020 - please take the time to watch the video at the end (foresight was 2020) or click here .